Table of Content

Copyright © 2022 At Home Stores LLC. Selection, quantities and pricing of products may vary by participating store. The payment date will be based on the actual date of payment. You may get in touch with our customer service to request for cancellation. In the event of the cardholder’s accidental death or dismemberment of certain body parts due to accident, the cardholder or beneficiary can avail additional benefits of up to 120% of the outstanding balance. Moreover, you may be asked to input the 6-digit one-time password that will be sent to you via text or via email depending on your chosen method.

For your safety, we would like to remind you not to share any of these details with anyone. We will send you an SMS to let you know when to pick up the card and some other details. Credit cards can be delivered from Monday to Saturday and on holidays. If your card gets lost or stolen, you don’t have to worry about any unauthorized transactions. Your family is also protected in case of unforeseen death or accident.

Get up to ₹75,000 pre-approved credit limit

Some information and features are not available yet—but don’t worry. It may take up to 3 business days for your full online experience to be ready. Buy digital gold online in a few clicks, starting at just ₹1! Start your gold savings today to fulfill your family’s wishes in the future.

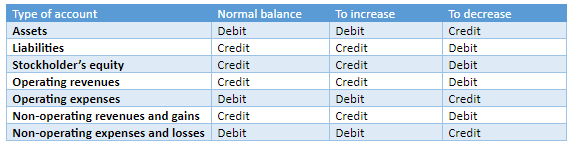

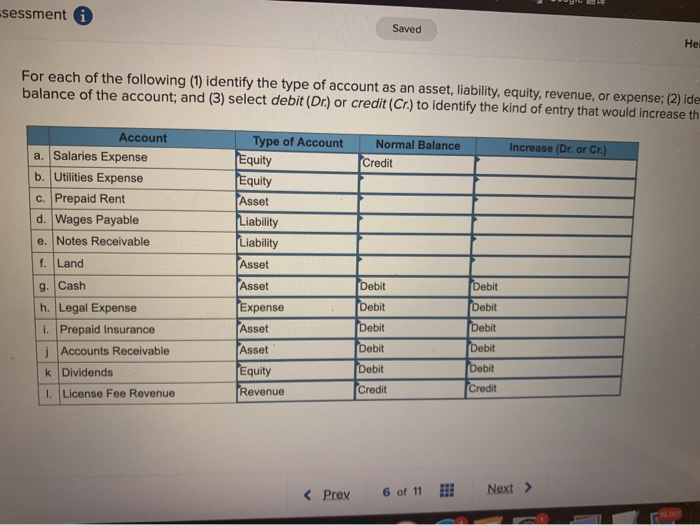

Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. Please note that these are a group in the account book of a firm exhibiting the amount due. On the debit credit balance sheet, a debit to these accounts means liability cutback while a credit denotes liability increment.

What is the validity of my credit card?

Any adverse situation is costly and stressful for all parties and we’ve structured Balance to avoid them by being flexible about how much of your home you own. If you cannot afford to pay your minimum monthly payments and have exhausted your ability to pay with equity, we will make every effort to accommodate any alternative financing options. A sale of the residence, where you share in the proceeds accordingly, is a last resort option. Balance invests in your home in exchange for a portion of your home equity. As a co-owner, Balance shares in the costs, appreciation and depreciation of your home. Sharing in your future home appreciation allows Balance to offer attractive terms with low monthly payments and flexible qualifying criteria.

Select cardholders get a chance to have their credit limit increased if they have a good credit standing and payment history. You can view your real-time transaction, transaction history, card balance, and monthly billing statement. An installment plan gives you payment flexibility to convert qualified purchases into installment over a certain period. Your monthly installment amount will be part of your Minimum Amount Due. Bankrate.com is an independent, advertising-supported publisher and comparison service.

The PIN I re-entered is incorrect, what should I do?

This protection helps to ensure that the information you send and receive will remain confidential. The credit balance is the full amount credited to the cash account after implementing the short sale order. We're looking for new team members at many of our locations nationwide. Don't worry about missing a payment or falling behind—choose to pay with equity instead of cash.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. If your email address changes, please update it through Account Online or call us at the number on the back of your card. Please note that it has two chief subaccounts on the debit credit balance sheet, namely capital transfer and acquisition and disposal of non-produced, non-financial assets. Moreover, the examples encompass partnerships and LLCs, sole proprietorships, and shareholders.

What should I do if I did not receive my e-statement?

Any payment made on a weekend or holiday will be applied as of the day you make it. Enjoy the convenience of cashless payments and save on your shopping as well. The "similar styles" price noted is our researched retail price at a point in time of similar style of aesthetic item at another retailer offering home décor products.

Therefore, paying up lesser than their statement balance will put the account in good standing, though they will incur interest rates. Meanwhile, the customers must prioritize the payment of their statement balance over the current balance. To enroll in paperless for this credit account, start by reading the terms and conditions below. We will send notifications regarding the availability of your statement online and legal notices to the email address you provided to us until you contact us to change it.

Couples with no children have the highest median balance, while single parents have the lowest. Again, the average balance is skewed by outliers, so the median balance may be more representative of how much households have saved. The median transaction account balance is $5,300, according to the Federal Reserve’s Survey of Consumer Finances , with the most recently published data from 2019. Transaction accounts include savings, checking, money market and call accounts, as well as prepaid debit cards.

Your advance payment will be reflected as your payment on your next monthly billing statement. To avoid interest charges, we advise you to pay the Total Amount Due on or before your due date. That is the total amount charged to your credit card within the billing period. Yes, there is a minimal monthly membership fee depending on your product package. The applicable amount will not be charged until your first transaction.

You may cancel through account online or by calling us at the number on the back of your card. It is shown as the part of owner’s equity in the liability side of the balance sheet of the company. Deferred Tax LiabilitiesDeferred tax liabilities arise to the company due to the timing difference between the accrual of the tax and the date when the company pays the taxes to the tax authorities. This is because taxes get due in one accounting period but are not paid in that period. Secured LoansSecured loans refer to the type of loans approved and received against a guarantee or collateral.